Subtotal $0.00

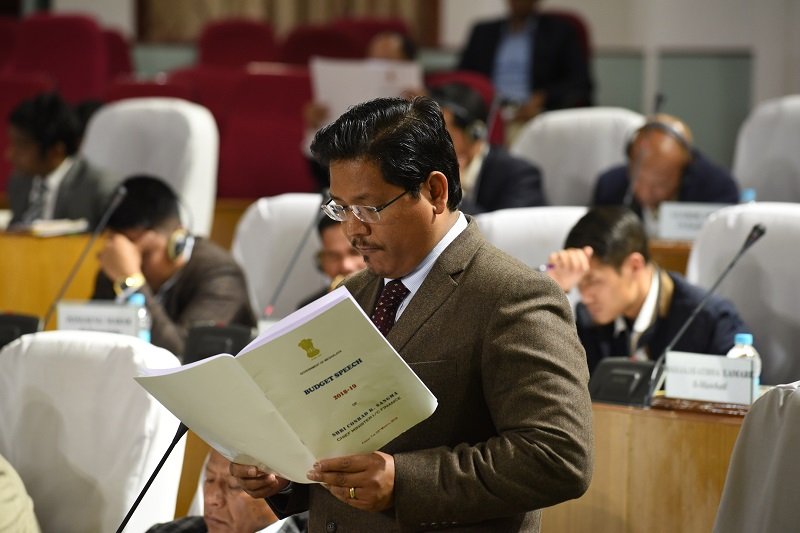

Shillong Mar 23: Meghalaya chief minister, Conrad K. Sangma presented a state budget for the year 2018-2019 in Assembly with a fiscal deficit of Rs 1,150 crore.

The chief minister who holds finance portfolio stated this while delivering a 37-page budget speech in Assembly on Friday where the budget estimates of the state was presented along with the Vote-on-Account for the proposed expenditure during the first three months of the year 2018-19 from April 1 to June 30.

“For 2018-19, I have estimated the total receipts at Rs 14,104 crore, of which the revenue receipts are estimated at Rs 12,531 crore and capital receipts at Rs 1,573 crore. Excluding borrowings, the total receipts are estimated to be Rs 12,554 crore,†Conrad said.

On the expenditure side, he said, “I have estimated the total expenditure at Rs 14,101 crore during 2018-19, of which revenue expenditure is estimated at Rs 12,036 crore and capital expenditure at Rs 2,065 crore. Excluding repayment of loans, the estimated total expenditure is Rs 13,704 crore.â€

With the total receipts of Rs Rs 12,554 crore lesser than the total expenditure of Rs 13,704 crore, the Chief Minister announced that the budget of 2018-2019 has a fiscal deficit of Rs 1,150 crore, which is around 3.32 per cent of the Gross State Domestic Product (GSDP).

Last the fiscal deficit was Rs 1,236 crore which was around 3.8 per cent of the GSDP.

Conrad said that the interest payment during 2018-19 was estimated at Rs 653 crore and pension payment at Rs 784 crore.

On tax and non tax revenue, the Chief Minister said that the system of revenue collection would be reviewed and pro-active steps would be taken in tax-planning.

“There is scope for better collection in the coming years, in view of the major shift to the new tax regime of Goods & Services Tax (GST). Areas which need more focus and improvement will be identified and remedial steps will be taken. The Government will continue to adopt a series of direct verification of case records of large tax payers, besides revision of assessment whenever necessary to increase Government revenue. “

Besides this, he said that more stress would be laid on scrutiny and assessment of returns of dealers under relevant Acts which have not been subsumed under the new regime in order to unlock revenue held up due to pending proceedings.

“In this connection, it may be mentioned that revenue collection on IMFL & MPGT Act during the year 2017-18 upto December 31, 2017, was higher as compared to the revenue collection for the same period during 2016-17,†he said.

In 2017-18, the State’s own tax revenue was Rs 1,559 crore, and State’s own non-tax revenue was Rs 513 crore. For 2018-19, the State’s own tax revenue is estimated at Rs 1,716 crore, and State’s own non-tax revenue at Rs 538 crore.